(01)

PROJECT CONTEXT

ABSA, one of South Africa's leading financial institutions serving 59 million banked customers, faced a critical inflection point: 31% of customers still relied primarily on physical branches despite aggressive digital transformation initiatives. With 3,800+ branches serving as community hubs across diverse linguistic and cultural contexts, the challenge wasn't simply digitization—it was reimagining banking that respected South Africa's multicultural reality while achieving operational efficiency. This represented a fundamental shift from technology-first to human-centered design thinking in financial services.

(02)

THE STRATEGIC CHALLENGE

Traditional banking transformation assumes digital literacy and trust, but South African reality revealed deeper complexities: customers with smartphones preferred branches for "important" transactions; language preferences varied by transaction type; and banking was often a community activity embedded in cultural practices. The strategic question evolved from "How do we move customers online?" to "How might we design banking experiences that respect cultural diversity while reducing operational friction?"

Success metrics balanced business efficiency with human impact: reduce average wait times from 23 to 15 minutes, increase satisfaction from 6.2 to 8.0/10, achieve 85%+ task completion for users 55+, and deliver genuine multilingual support across 7+ languages. These weren't arbitrary targets—they represented the threshold where operational efficiency and customer dignity intersected.

(03)

RESEARCH METHODOLOGY

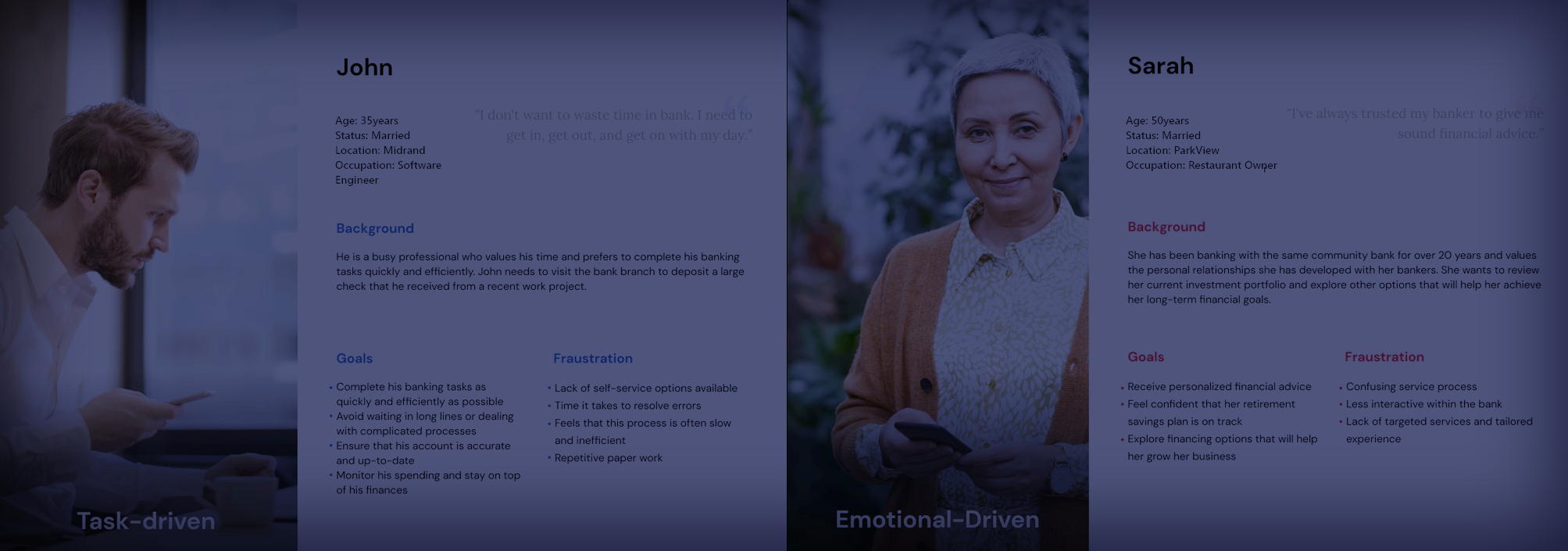

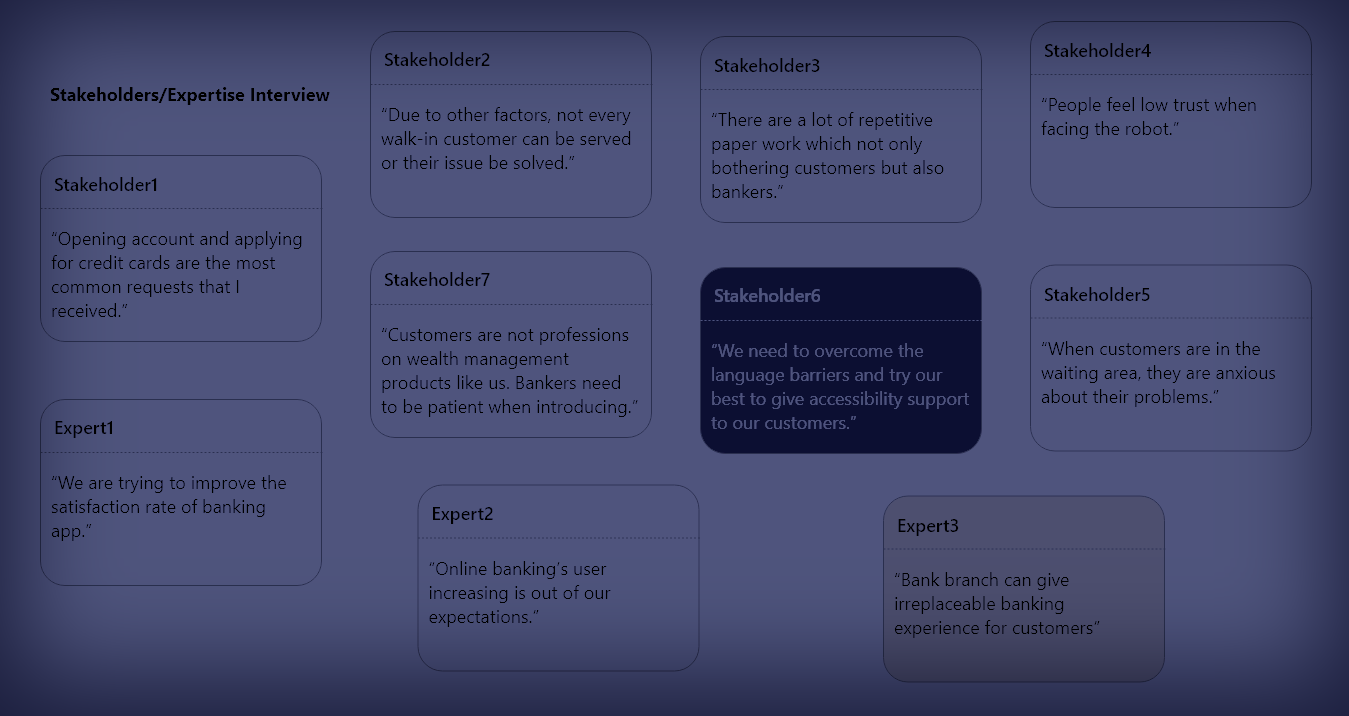

I deployed a multi-method ethnographic approach combining contextual inquiry, stakeholder mapping, and cultural analysis. Extended observational studies across urban and township branches revealed that queues served social functions beyond transactions—they were networking opportunities and community touchpoints. This insight fundamentally reframed the problem from "eliminating waits" to "optimizing time value."

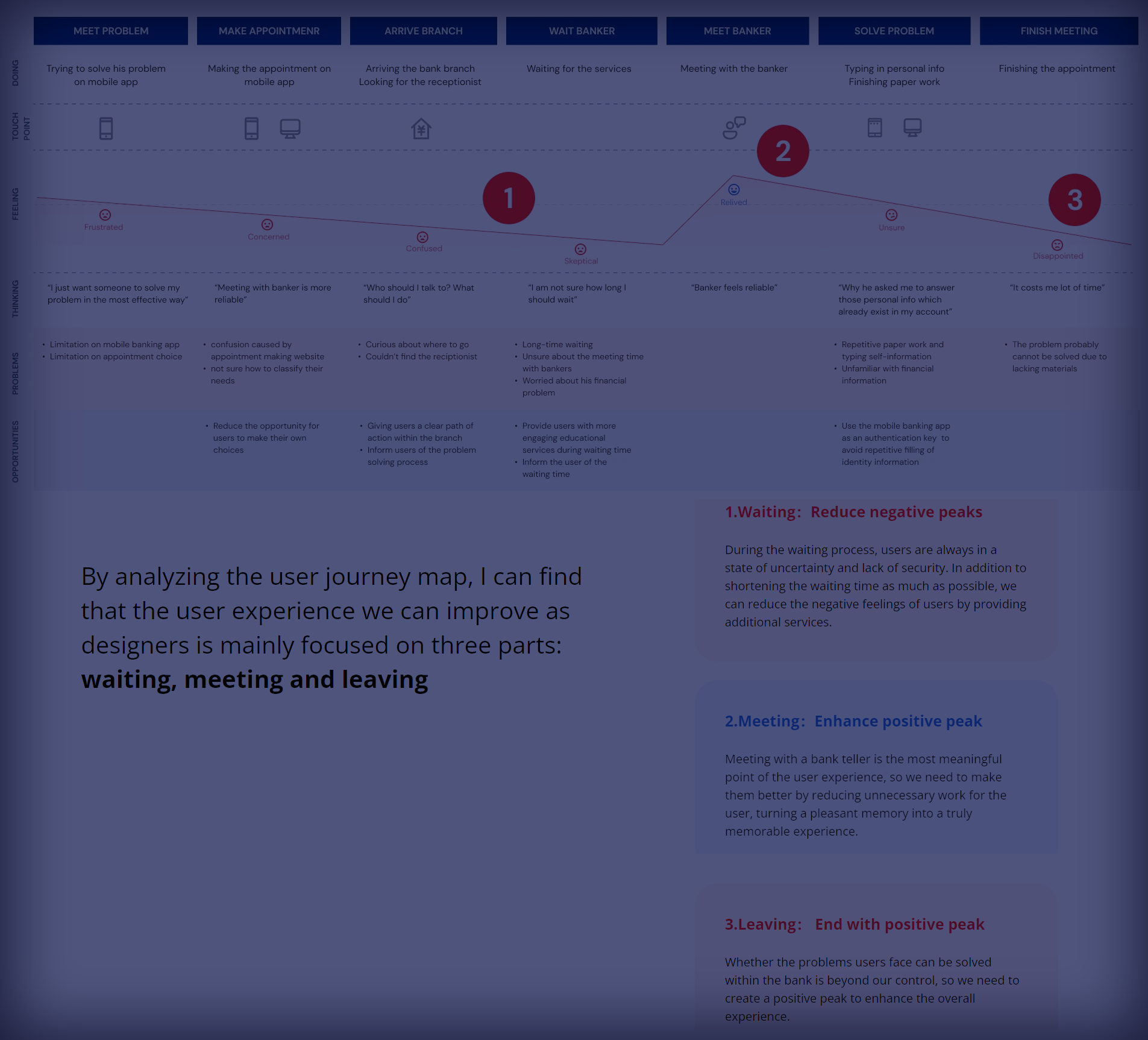

Stakeholder interviews with branch staff uncovered a critical insight: tellers weren't resistant to digital tools—they were frustrated by systems that increased administrative burden without enhancing customer service. This revealed a design opportunity in staff experience as much as customer experience. Journey mapping across three primary personas exposed emotional inflection points: pre-visit anxiety, arrival assessment, trust-building interactions, and post-transaction reflection. Each phase presented distinct design opportunities.

The research challenged my assumptions repeatedly: tech literacy didn't correlate with digital trust; language preference wasn't static but context-dependent; and efficiency wasn't universally valued—some customers measured success by feeling understood, not transaction speed. These insights demanded moving beyond "best practices" to culturally grounded design principles.

(04)

DESIGN STRATEGY & SOLUTIONS

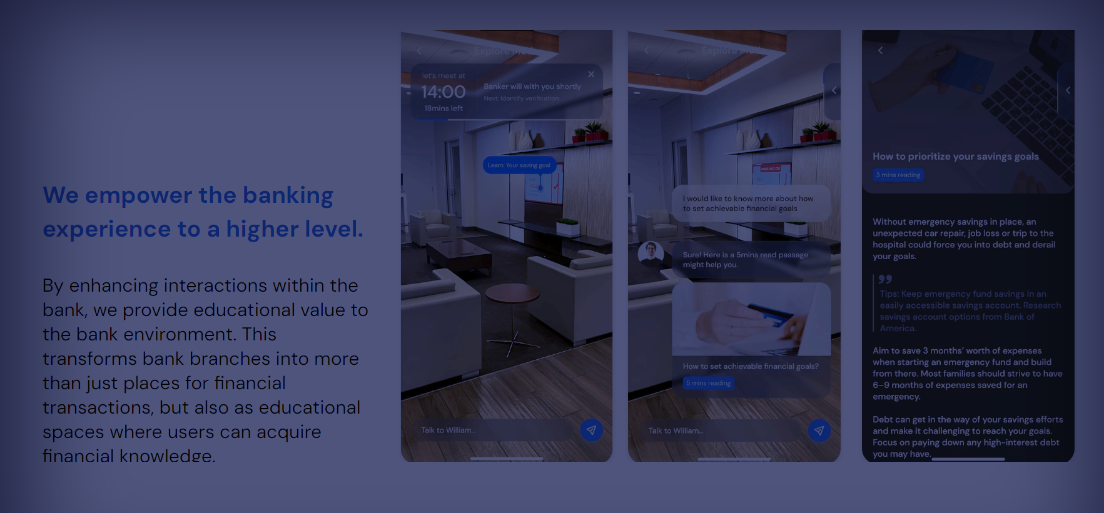

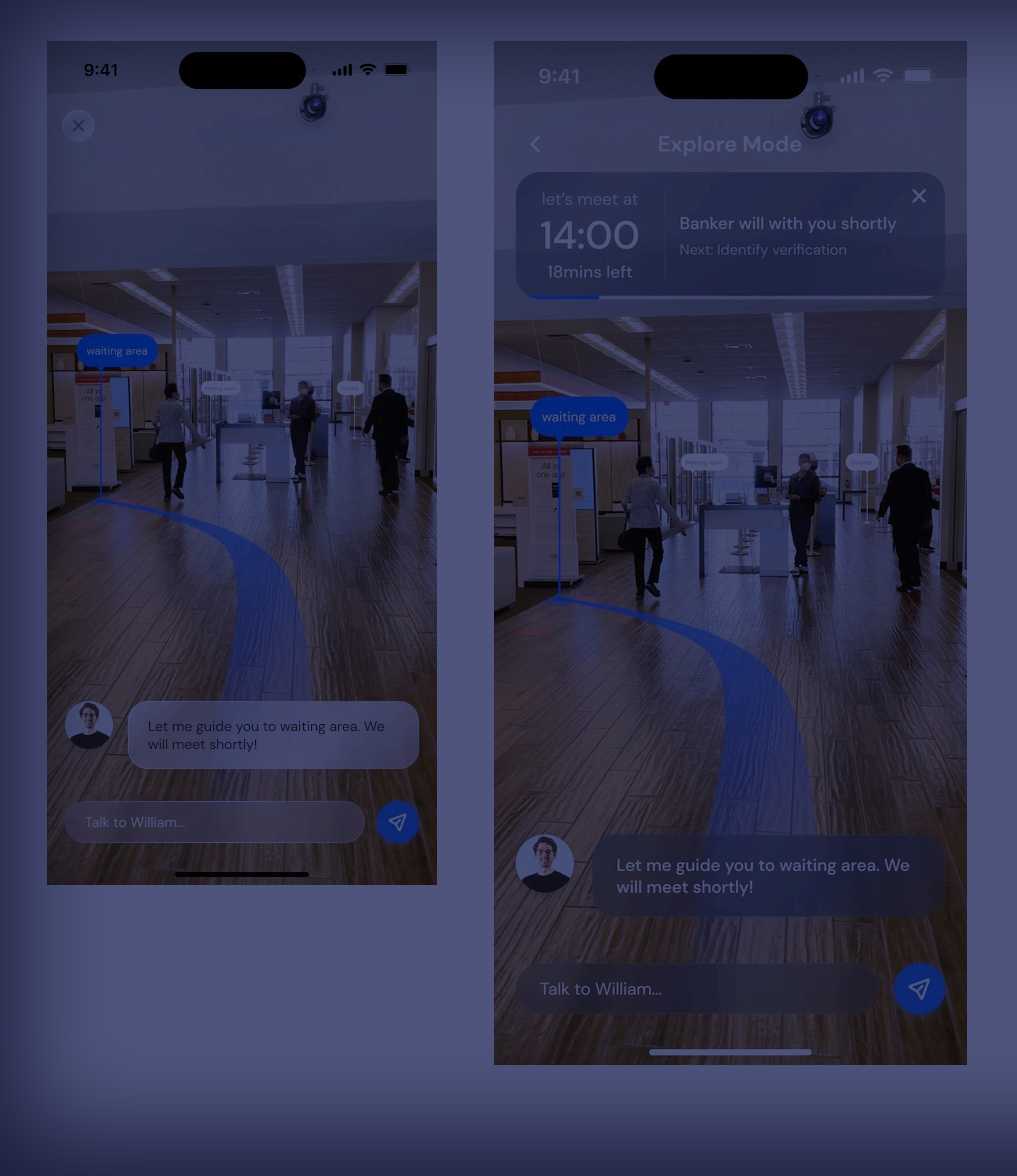

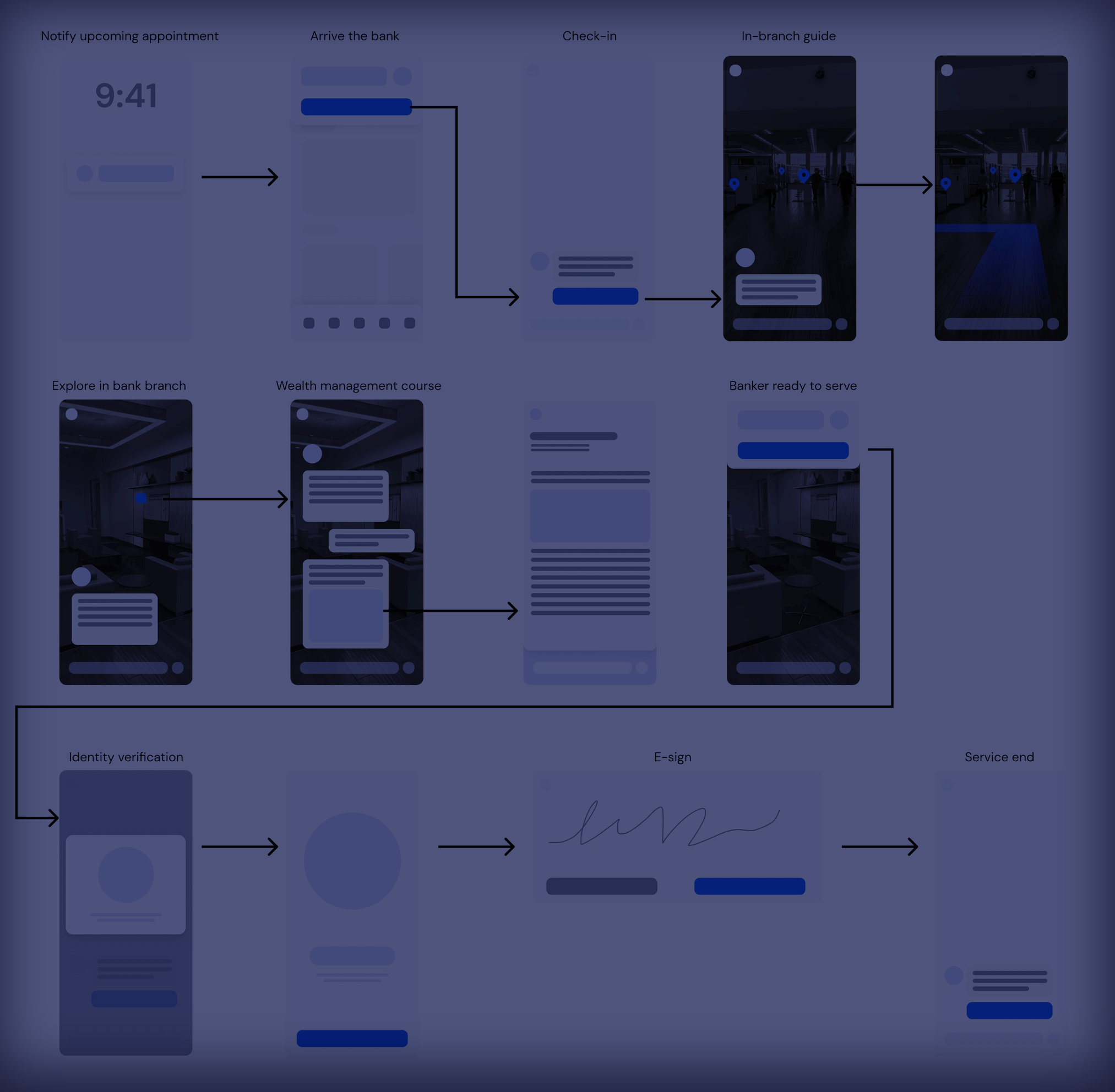

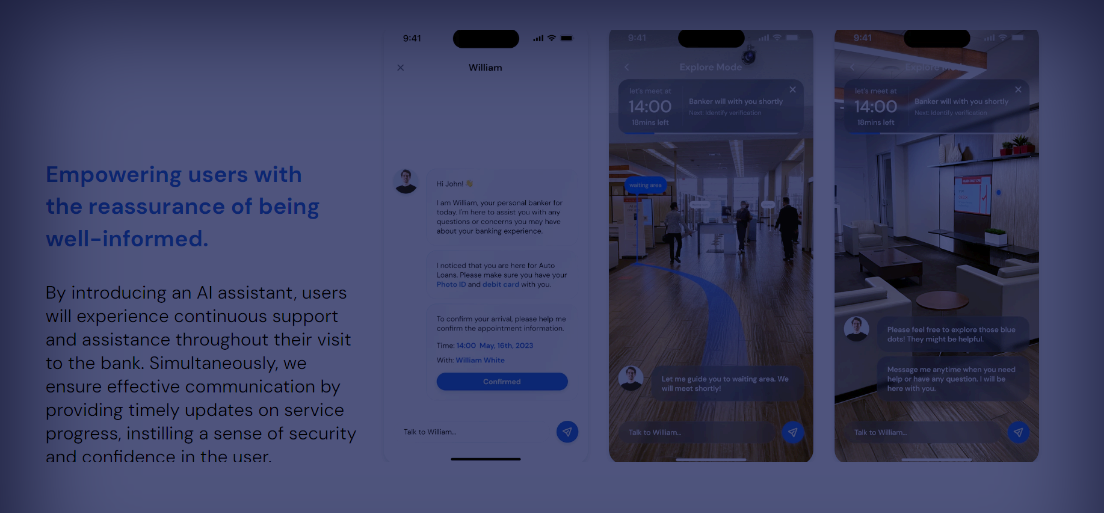

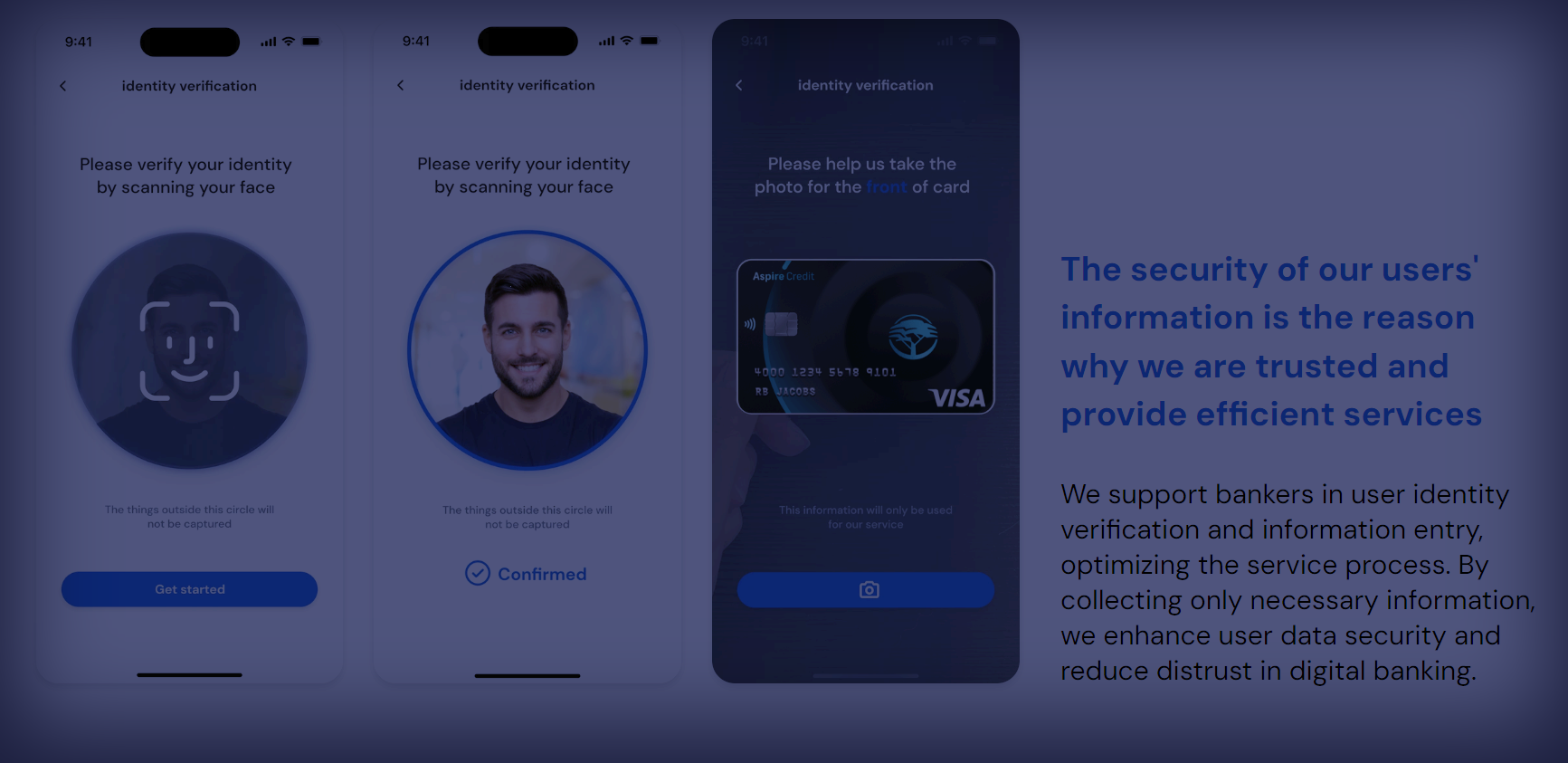

The solution architecture centered on four integrated systems: Queue Intelligence (predictive wait times and optimal visit scheduling), Preparation Assistant (transaction-specific checklists reducing repeat visits), Cultural Concierge (language and cultural preference matching), and Progressive Trust Building (graduated digital adoption through positive experiences).

• Hybrid digital-physical experience maintaining human

relationships while reducing administrative friction

• Context-aware language switching respecting cultural

communication preferences beyond simple translation

• Staff empowerment tools providing customer context without

privacy violations

• Transparent queue systems with actionable intelligence

rather than passive wait times

• Post-transaction educational content building confidence

for future self-service

• Accessibility considerations for varying tech literacy and

data constraints

(05)

VALIDATION & IMPACT

Iterative testing revealed that emotional comfort metrics predicted adoption better than traditional usability scores. Task completion improved from 73% to 87%, but more significantly, user confidence scores increased from 6.1 to 7.8/10, and 89% expressed return intention. The most telling validation came from qualitative feedback: "This feels like someone actually thought about how I do things, not how they think I should do things."

35% reduction in branch friction while preserving valued human interactions

87% task completion rate for users 55+ demonstrating inclusive design effectiveness

Framework validated for culturally-grounded design in emerging markets financial services

(06)

STRATEGIC INSIGHTS

This project fundamentally challenged the assumption that inclusive design in emerging markets means simplification or feature reduction. Instead, it demonstrated that cultural sophistication requires *more* design intelligence, not less. The framework developed—balancing operational efficiency with cultural respect, digital capability with trust-building, and standardization with contextual flexibility—has implications beyond financial services for any global organization operating in culturally diverse markets.

The most significant learning: designing for dignity and efficiency aren't opposing forces—when cultural context is deeply understood, they become mutually reinforcing. This shifts the conversation from "how do we get users to adopt our solution" to "how do we design solutions worthy of their trust." That reframing represents mature UX thinking that transcends tactics to address strategic business and human outcomes.